very account: How It Works, Benefits & Credit Explained

Online shopping has evolved far beyond simple card payments, and flexible credit options have become increasingly popular among UK consumers. One such option is the Very account, a payment facility offered by Very.co.uk that allows customers to spread the cost of purchases over time. For shoppers who want convenience, flexibility, and access to Buy Now Pay Later options, a Very account can feel like a practical solution—especially when managing larger purchases such as furniture, electronics, or family essentials.

The appeal of a Very account lies in its simplicity. Instead of paying the full amount upfront, customers can choose from various payment plans that suit their budget. This flexibility makes it easier to manage cash flow while still enjoying immediate access to products. However, like any credit option, it comes with responsibilities, including understanding interest rates, fees, and how repayments work.

This guide provides a detailed look at the Very account, explaining how it works, how to apply, the benefits and risks, and how to manage it responsibly. Whether you’re considering opening a Very account or already have one, this article will help you make informed decisions and use your account wisely.

What Is a Very Account?

A Very account is a credit account that allows customers to shop on Very.co.uk without paying the full cost immediately. Instead, purchases are added to the account balance, and customers can choose how and when to repay. This setup is designed to give shoppers flexibility, particularly for higher-value items or planned purchases spread across several months.

One of the key features of a Very account is its Buy Now Pay Later option. Depending on the promotion, customers may be able to delay payments for a set period before interest is applied. Alternatively, they can opt for monthly repayments, spreading the cost over time. This makes the Very account attractive to shoppers who prefer structured payment plans rather than one-off payments.

Eligibility for a Very account typically involves a credit check, as it is a form of consumer credit. Approval and credit limits depend on individual circumstances, including credit history and affordability checks. Once approved, customers receive an initial credit limit, which may increase over time with responsible use.

Understanding what a Very’account is—and how it differs from standard payment methods—is essential. While it offers convenience and flexibility, it also requires careful management to avoid unnecessary interest or fees.

How to Apply for a Very Account

Applying for a Very account is a straightforward process that usually takes place during checkout or account registration on Very.co.uk. Customers are asked to provide basic personal details, including address history and financial information, to assess eligibility. The application is typically quick, with many users receiving an instant decision.

Once approved, customers are given a credit limit that determines how much they can spend using their Very account. This limit may start modestly but can increase over time if payments are made on time and the account is managed responsibly. It’s important to remember that approval is not guaranteed, as Very performs affordability and credit checks before granting access.

After approval, the Very account becomes available immediately for use. Purchases made using the account are added to the balance, and repayment options are presented at checkout. These may include Buy Now Pay Later offers or monthly payment plans with interest.

Before applying, it’s wise to consider whether a Very account fits your financial situation. While the convenience is appealing, understanding your repayment ability ensures that the account remains a helpful tool rather than a financial burden.

Very Account Credit Options Explained

The Very account offers several credit options designed to suit different shopping needs. One of the most popular is Buy Now Pay Later, which allows customers to delay payments for a set period. During this time, no payments may be required, but interest often applies if the balance isn’t cleared by the end of the promotional period.

Another option is spreading the cost through monthly repayments. With this method, customers make minimum payments each month, with interest applied to the outstanding balance. The interest rate, often expressed as a representative APR, determines how much extra is paid over time.

Understanding how interest is calculated is crucial. Interest is usually charged on the remaining balance, meaning the longer it takes to repay, the more the purchase costs overall. Making only minimum payments can extend repayment periods significantly.

Choosing the right credit option depends on personal circumstances. For short-term flexibility, Buy Now Pay Later can be useful, while structured monthly payments suit those who prefer predictable budgeting. Knowing the costs upfront helps avoid surprises later.

Managing Your Very Account Online

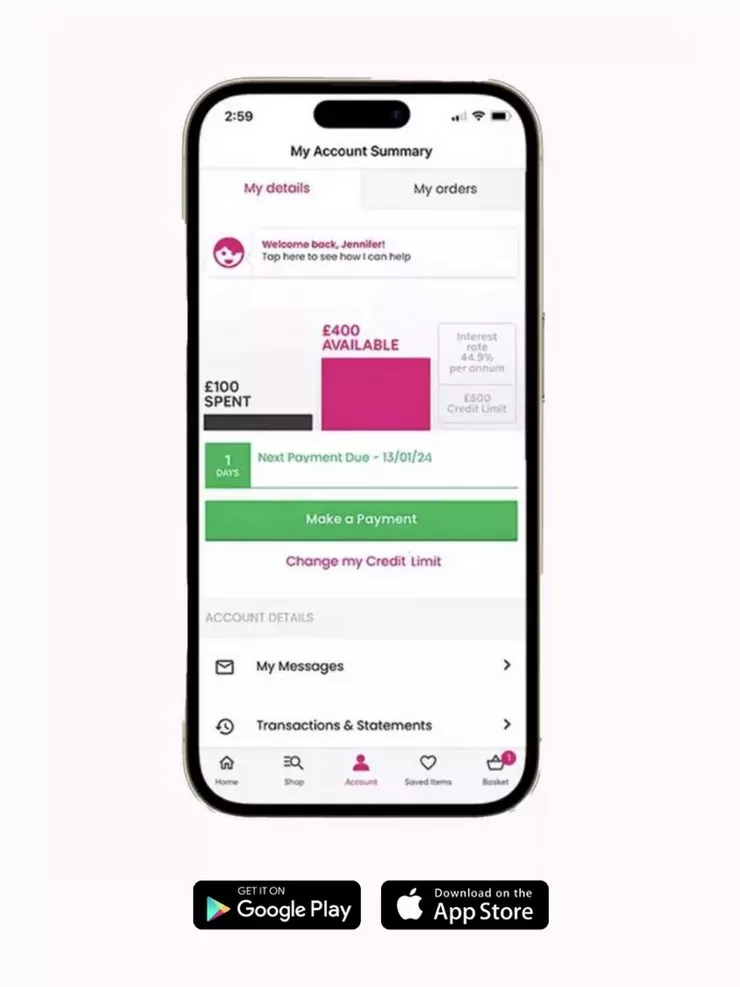

Managing a Very account is done primarily through the online account dashboard. This area allows customers to view balances, track purchases, and see upcoming payment due dates. Regularly checking your account helps you stay informed and avoid missed payments.

Payments can be made online using debit cards or by setting up a direct debit. Direct debits are especially useful for ensuring minimum payments are made on time, reducing the risk of late fees. Customers can also make additional payments to reduce their balance faster and minimise interest.

The account dashboard also provides access to statements, showing how much has been spent, repaid, and charged in interest. Keeping an eye on these details supports better financial control and responsible account use.

By actively managing your Very account, you can enjoy its benefits while keeping costs under control. Organisation and awareness are key to making the account work in your favour.

Benefits and Risks of Using a Very Account

One of the main benefits of a Very account is flexibility. Being able to spread costs or delay payments can make shopping more accessible, especially for larger purchases. Account holders may also receive exclusive offers or promotions not available to standard payment users.

However, there are risks to consider. Interest charges can add up quickly if balances aren’t cleared promptly. Late payments may result in fees and could negatively impact your credit score. This makes responsible borrowing essential.

A Very account works best for shoppers who plan their repayments carefully and understand the terms. Used wisely, it can be a helpful budgeting tool. Used carelessly, it can become expensive over time.

Conclusion

A Very account offers UK shoppers a flexible way to manage online purchases, combining convenience with structured payment options. From Buy Now Pay Later deals to monthly repayment plans, it provides solutions for different financial needs. However, understanding interest rates, fees, and repayment responsibilities is essential to avoid unnecessary costs.

When used responsibly, a Very account can support smarter shopping and better budgeting. The key is awareness—knowing when to use it, how to manage it, and when to pay off balances promptly. With the right approach, a Very account can be a valuable tool rather than a financial risk.

Frequently Asked Questions (FAQs)

What is a Very account used for?

It allows customers to shop on Very.co.uk using credit and flexible payment options.

Does a Very account affect my credit score?

Yes, as it is a form of credit, it can impact your credit score positively or negatively depending on usage.

Can I increase my Very account credit limit?

Credit limits may increase over time with responsible account management.

What happens if I miss a payment?

Missing a payment may result in fees and could affect your credit rating.

Can I use a Very account without paying interest?

Some Buy Now Pay Later offers allow interest-free periods if balances are cleared on time.

How do I check my Very account balance?

You can view your balance through the online account dashboard.

Is a Very account worth it?

It can be worthwhile if used responsibly and with a clear repayment plan.

You May Also Read: Next Home