Argos Discount Code 2026: Latest Offers and Promo Deals

Argos, one of the UK’s most popular retailers, offers a wide variety of products ranging from electronics and home appliances to toys, furniture, and seasonal items. While its extensive catalogue is convenient, savvy shoppers know that combining quality products with smart savings is the key to maximising value. This is where Argos discount code come into play. These codes provide shoppers with the opportunity to save money, enjoy exclusive offers, and even access perks like free delivery on selected items.

Discount codes, also known as promo codes or voucher codes, have become increasingly popular in the digital age. They work by applying a specific code during checkout, which automatically deducts a percentage or fixed amount from the total price. Some codes offer free shipping or additional incentives, such as gifts or loyalty points. By using Argos discount codes strategically, shoppers can significantly reduce their expenses, whether purchasing everyday essentials, gadgets, or high-ticket items.

Argos discount codes come in various forms, catering to a wide range of shoppers. Some are exclusive to online orders, while others can be redeemed in-store. Seasonal promotions, clearance events, and app-exclusive deals provide additional ways to save, making it essential for customers to stay updated and informed. The appeal of these codes is not just monetary—they also encourage customers to explore new products and enjoy the convenience of flexible, cost-effective shopping.

Ultimately, Argos discount codes are an excellent way to combine convenience, affordability, and rewards. They appeal to budget-conscious shoppers while providing a hassle-free shopping experience. By understanding the types of codes available and how to use them effectively, consumers can optimise their purchases and make the most of every shopping trip, both online and in-store.

Types of Argos Discount Codes

Argos discount codes come in a variety of forms, each designed to deliver savings in a slightly different way. The most common type is the percentage discount code, which reduces the total price of a purchase by a set percentage. For example, a 10% off code can save £10 on a £100 order. These codes are particularly effective for high-value items, as the percentage discount scales with the total cost.

Another popular type is the fixed amount discount code, which deducts a specific amount from your order, such as £5 or £20 off. These are often used for smaller purchases or to encourage first-time customers to make a purchase. They provide immediate and predictable savings, making it easy for shoppers to calculate their final costs.

Free delivery codes are highly sought after by online shoppers. They allow customers to receive their products without paying shipping fees, which can add up significantly, especially for bulky items like furniture or home appliances. Some codes are also app-exclusive or newsletter-only, offering additional savings to users who engage with Argos digitally. These codes encourage customers to download the app or sign up for updates, enhancing convenience and loyalty.

Finally, seasonal and clearance codes are released during major shopping events such as Black Friday, Christmas, summer sales, or back-to-school promotions. These codes often combine multiple perks, such as discounts and free shipping, and can be stacked with loyalty programs for maximum savings. By understanding the various types of Argos discount codes, shoppers can choose the right code for their purchase and optimise their savings strategy.

How to Use Argos Discount Codes Effectively

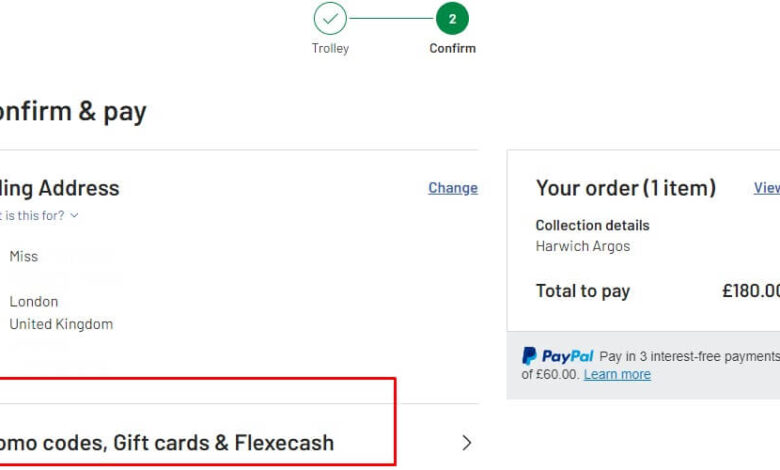

Using Argos discount codes effectively requires a combination of knowledge, timing, and attention to detail. The most basic method is applying the code during checkout. For online purchases, shoppers enter the code in a dedicated promo box before completing payment. Once applied, the discount is reflected immediately in the order total. In-store redemption may require showing the code at the counter or via a mobile device.

Verifying the code is crucial to avoid disappointment. Many codes come with restrictions, such as minimum spend requirements, exclusions on certain product categories, or expiry dates. Always check the terms and conditions before applying a code to ensure it is valid for your intended purchase. Using expired or ineligible codes can result in frustration and missed savings opportunities.

Timing your purchase strategically can also maximise benefits. Certain discount codes are released during specific events or sales periods, so shopping during these times often provides the largest savings. Additionally, combining codes with ongoing promotions, loyalty points, or student discounts can significantly reduce the total cost. However, note that not all codes can be stacked, so understanding the limitations is essential.

Finally, staying organised helps in utilising codes effectively. Keep a list of active codes, monitor newsletters, and follow social media accounts that frequently post promotions. By planning purchases around available codes and offers, shoppers can ensure they receive the maximum value on every Argos order, whether purchasing small household items or high-ticket electronics.

Where to Find Argos Discount Codes

Finding legitimate Argos discount codes is simpler than ever due to the variety of sources available. The official Argos website is the first and most reliable source. Customers can check the dedicated offers section or sign up for newsletters to receive exclusive codes directly in their inbox. The Argos mobile app is another excellent source, often featuring app-only codes that provide unique savings.

Third-party coupon websites are another popular method for finding Argos discount codes. These sites aggregate codes from multiple sources, including seasonal promotions and user-submitted deals. However, it is crucial to verify the legitimacy of these codes to avoid expired or fraudulent offers. Trusted platforms often indicate whether a code is active and provide user feedback on success rates.

Social media channels also play a key role in discount code distribution. Influencers, bloggers, and Argos’ own social accounts frequently share limited-time codes, flash deals, or exclusive promotions. Following these accounts ensures that shoppers stay informed about the latest opportunities to save.

Email alerts and subscriber-only promotions provide additional ways to access exclusive deals. Signing up for Argos newsletters can offer early access to sales, app-based codes, and unique vouchers that are not available elsewhere. By combining multiple sources, shoppers can maximise their chances of finding the best Argos discount codes for their needs.

Benefits of Using Argos Discount Codes

The primary benefit of Argos discount codes is financial savings. By applying a code, shoppers can significantly reduce the cost of products, sometimes by as much as 20% or more during seasonal sales. Savings can apply to a wide range of products, including electronics, home goods, toys, and furniture, making it relevant for almost every type of shopper.

Discount codes also offer access to exclusive deals that are not available to general customers. App-only codes, newsletter promotions, and limited-time offers provide additional perks, making the shopping experience more rewarding. These promotions can include free gifts, loyalty points, or vouchers redeemable on future purchases, adding tangible value beyond monetary discounts.

Another advantage is encouragement to explore new products. Shoppers may be more willing to try items they have been considering, knowing that a discount reduces financial risk. This not only enhances customer satisfaction but also allows consumers to experience a broader range of Argos products without overspending.

Finally, using discount codes enhances overall shopping efficiency. By strategically combining codes, seasonal sales, and loyalty rewards, shoppers can optimise their spending, save time, and ensure they get the most value from every purchase. The convenience, affordability, and flexibility of Argos discount codes make them an essential tool for modern UK shoppers.

Common Mistakes and How to Avoid Them

While Argos discount codes are easy to use, shoppers sometimes make avoidable mistakes. One common error is using expired or invalid codes, which results in disappointment at checkout. Always check expiry dates and terms before applying a code.

Another mistake is ignoring the terms and conditions, such as product exclusions or minimum spend requirements. Failing to read these rules can lead to ineligible codes or wasted time attempting to apply them.

Some shoppers attempt to stack multiple codes without verifying if they are compatible. Not all codes can be combined, so understanding limitations is essential to avoid frustration.

Finally, shoppers may overlook official sources, relying solely on third-party websites. While many of these sites are legitimate, always verify codes from trusted platforms to avoid scams or outdated offers. By staying organised, reading terms carefully, and timing purchases strategically, shoppers can avoid mistakes and maximise savings on every Argos purchase.

Conclusion

Argos discount codes are a valuable tool for UK shoppers looking to save money, access exclusive offers, and enhance their overall shopping experience. With a variety of code types, from percentage discounts to free delivery, there are multiple ways to benefit from these promotions.

By understanding how to find, apply, and combine codes effectively, consumers can make the most of their purchases and enjoy significant savings. Whether shopping online, in-store, or via the app, Argos discount codes provide flexibility, convenience, and value. Staying informed and strategic about using these codes ensures that every shopping trip is both cost-effective and rewarding.

Frequently Asked Questions (FAQs)

What is an Argos discount code and how does it work?

An Argos discount code is a promotional code applied during checkout to reduce the total cost, offer free delivery, or provide exclusive perks.

Are Argos discount codes available online and in-store?

Yes, most codes are redeemable online, while some can also be used in-store. Check the code terms before using.

Can I use multiple Argos discount codes on one purchase?

Not always. Some codes cannot be combined, so review the terms and conditions before attempting to stack them.

Where can I find the latest Argos discount codes?

Codes are available on the Argos website, mobile app, newsletters, social media, and verified third-party coupon sites.

Do Argos discount codes have an expiry date?

Yes, most codes are time-limited. Always check the validity period to ensure it is active before use.

Are Argos app-only discount codes better than regular codes?

App-only codes may offer exclusive discounts, additional rewards, or perks unavailable elsewhere.

Can Argos discount codes be used during sales or clearance events?

Many codes can be combined with seasonal sales, but always read the terms to confirm eligibility.

Is it safe to use Argos discount codes from third-party websites?

Yes, if sourced from reputable and verified coupon websites. Avoid unknown sources to prevent scams.

You May Also Read: M&S Bank