Is Pockit Bank Safe? A Complete Review of Security, Features, and User Trust in 2025

As digital banking continues to reshape the financial world, more consumers are turning to app-based services like Is Pockit Bank Safe for convenience and accessibility. Designed primarily for people who want quick, affordable, and inclusive banking options, Pockit has become a popular choice in the UK’s growing fintech landscape. However, with this rapid rise in popularity comes a crucial question — is Pockit Bank safe?

Financial safety has become one of the top concerns for online banking users. Unlike traditional high-street banks, digital alternatives often rely on e-money licenses, not full banking licenses, leading many to wonder about the level of protection their funds receive. In this article, we’ll explore how Pockit operates, its safety measures, customer experiences, and how it compares to other digital banks.

By the end, you’ll have a clear, fact-based understanding of whether Pockit is a trustworthy and secure choice for managing your finances in 2025.

What Is Pockit Bank Safe and How Does It Work?

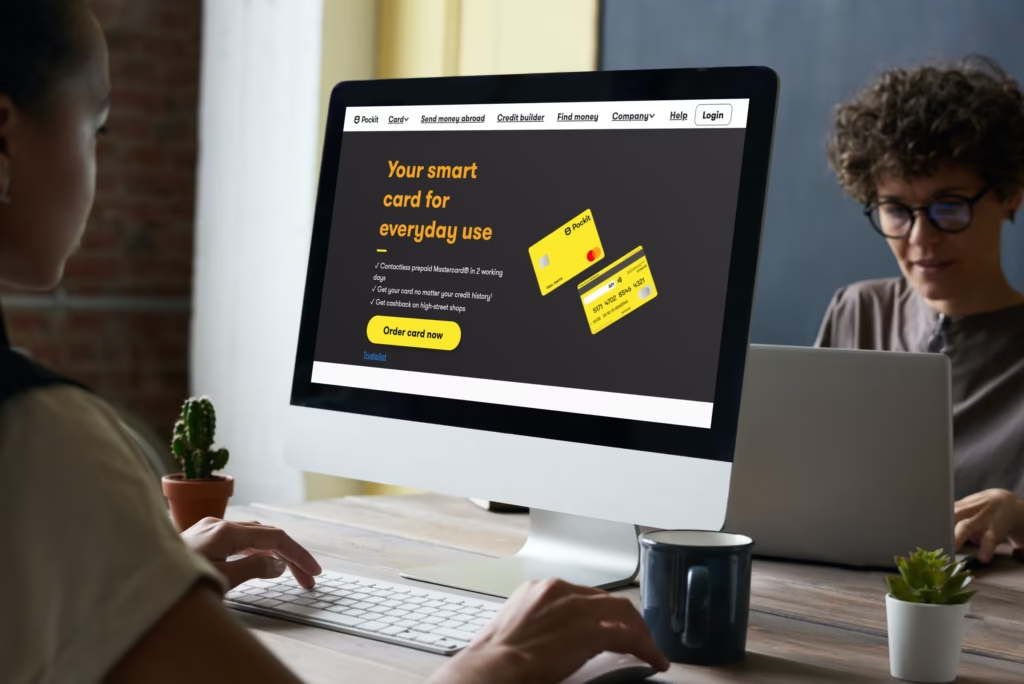

Pockit Bank is not a traditional bank but an e-money account provider based in the United Kingdom. Founded in 2014, Pockit’s mission is to make banking accessible to everyone, especially individuals who have struggled to open accounts with traditional financial institutions. It offers customers a prepaid Mastercard, an online dashboard, and a mobile app to manage money easily and affordably.

Unlike typical banks, Pockit doesn’t require credit checks, making it appealing to those with poor credit history or no banking experience. Users can receive wages, benefits, and transfers directly into their accounts, use their card for everyday purchases, and even send money abroad.

However, it’s essential to understand that Pockit operates as an e-money institution rather than a bank. This means it cannot lend money, offer overdrafts, or provide interest-bearing accounts. Instead, Pockit’s focus is on simplicity, transparency, and financial inclusion, giving customers a basic yet functional tool to manage their finances digitally.

For users who value convenience and control without the complexity of traditional banking, Pockit provides a modern, low-barrier entry point into the digital financial ecosystem.

Is Pockit Bank Safe? Understanding Its Security and Regulation

One of the most important aspects of evaluating any financial service is its regulatory status. Pockit is a legitimate and regulated financial provider in the UK. It is registered with the Financial Conduct Authority (FCA) under PayrNet Limited, which is authorized to issue e-money and manage customer accounts.

Unlike traditional banks, Pockit is not covered by the Financial Services Compensation Scheme (FSCS). However, this does not mean your money is unprotected. Instead, Pockit follows strict safeguarding regulations under the Electronic Money Regulations 2011. This means customer funds are held in segregated accounts, separate from company finances. Even if Pockit were to face financial trouble, your money would remain secure and unaffected.

Pockit also takes cybersecurity seriously. The platform uses advanced encryption technologies, secure authentication systems, and fraud monitoring tools to keep your account safe. Compliance with GDPR ensures that all personal and financial data is handled responsibly and transparently.

In short, while Pockit may not provide FSCS protection like high-street banks, it does maintain robust safeguards and strong regulatory oversight that make it a secure option for digital money management.

Pros and Cons of Using Is Pockit Bank Safe

Like any financial service, Pockit comes with both advantages and limitations.

Advantages

One of Pockit’s biggest strengths is accessibility. Anyone can open an account within minutes using a smartphone — no credit checks or lengthy forms required. Its transparent pricing structure ensures customers know exactly what they’re paying for, avoiding hidden fees that traditional banks sometimes impose.

The Pockit Mastercard offers convenient features such as contactless payments, instant spending notifications, and the ability to block or unblock cards directly through the app. It’s also a great option for users managing benefits, as it accepts Universal Credit and wage deposits.

Disadvantages

However, Pockit is not without drawbacks. Since it’s an e-money service, customers don’t receive the same FSCS protection that comes with a full banking license. Some users have reported delays in customer support or transaction issues, especially during peak times.

Pockit also lacks advanced banking features like savings accounts, overdrafts, or investment options. For users who require a more comprehensive financial suite, alternatives like Monzo or Starling Bank might be more suitable.

What Real Users Say About Is Pockit Bank Safe

Customer feedback plays a vital role in understanding how safe and reliable a financial service truly is. On platforms like Trustpilot, Pockit has thousands of reviews with an overall “Great” rating, indicating strong user satisfaction. Many customers praise its ease of setup, affordability, and practicality for daily use.

However, not all experiences are perfect. Some users report delayed payments or slow customer support responses, particularly during high-volume periods. Pockit has acknowledged these issues publicly and continues to invest in improving response times and communication channels.

On the other hand, positive reviews often highlight how Pockit provides financial independence for those previously excluded from the traditional banking system. It’s widely appreciated for offering a fair, transparent, and inclusive service that genuinely helps users take control of their money.

Overall, while there’s room for improvement, the general consensus among users is that Pockit is a safe and trustworthy platform for everyday banking needs.

Comparing Pockit to Other Digital Banks

When comparing Pockit with other digital banking platforms like Monzo, Revolut, and Starling Bank, the differences mainly come down to regulation, features, and protection. Monzo and Starling are fully licensed UK banks covered by FSCS, meaning deposits up to £85,000 are insured. Pockit, on the other hand, operates under an e-money model — it safeguards funds but doesn’t offer the same insurance coverage.

However, Pockit excels in financial inclusion. It’s tailored for users who might not qualify for a full bank account, providing a gateway into digital finance. While Revolut and Monzo cater to tech-savvy professionals, Pockit remains focused on simplicity and accessibility, making it ideal for everyday transactions, budgeting, and benefit payments.

In essence, Pockit’s safety measures are different but not inferior — they serve a different purpose. For users who understand its scope and limitations, Pockit remains a secure and practical choice.

Conclusion

So, is Pockit Bank safe? The answer is yes — Pockit is a legitimate, regulated, and secure digital banking service. While it doesn’t offer FSCS protection, it follows strict FCA and e-money safeguarding rules that ensure customer funds remain protected.

Pockit may not replace traditional banks entirely, but it fills an important role in promoting financial inclusion for those who need accessible, transparent, and easy-to-use money management tools.

If you’re looking for a convenient, low-cost account for everyday use — and you understand how e-money protection works — Is Pockit Bank Safe and reliable option worth considering in 2025.

FAQs About Is Pockit Bank Safe

Is Pockit Bank Safe regulated by the FCA?

Yes, Pockit operates under PayrNet Limited, which is authorized and regulated by the Financial Conduct Authority (FCA).

Does Pockit offer FSCS protection?

No, as an e-money institution, Pockit is not covered by the FSCS. However, funds are safeguarded in separate accounts under FCA regulations.

Is my data safe with Pockit?

Yes. Pockit uses advanced encryption and complies with GDPR to protect your personal and financial information.

Can I use Pockit for my salary or benefits?

Absolutely. You can receive wages, benefits, and transfers directly into your Pockit account.

Is Pockit a real bank?

Technically, no. Pockit is an e-money provider, not a fully licensed bank, but it still offers many banking-like features securely.

You May Also Read: Shops Like Minga London