Head of Risk: Roles, Responsibilities, and Key Skills Explained

In an era defined by volatility, uncertainty, and technological disruption, the Head of Risk has become one of the most critical leadership roles in modern organizations. Once seen primarily as a compliance function, risk management today is a strategic cornerstone that shapes how companies plan, operate, and grow sustainably. The Head of Risk acts as the guardian of resilience, ensuring that organizations are prepared not just to survive unexpected events—but to thrive in their aftermath.

The significance of this role has grown dramatically in recent years. Global crises, such as financial instability, cybersecurity threats, pandemics, and supply chain disruptions, have exposed vulnerabilities across industries. In response, the Head of Risk’s responsibilities have evolved from simply monitoring threats to designing proactive strategies that align with business goals and stakeholder expectations.

More than a risk identifier, the modern Head of Risk is a strategic advisor and business partner, integrating risk thinking into every aspect of decision-making. Whether operating within banking, manufacturing, healthcare, or tech, this leader ensures that every major initiative is evaluated through the lens of risk, resilience, and opportunity.

Understanding the Role of a Head of Risk

Defining the Position

The Head of Risk—sometimes titled Chief Risk Officer (CRO) or Risk Director—is responsible for overseeing all aspects of an organization’s risk management framework. This includes identifying potential risks, assessing their impact, and developing mitigation strategies that safeguard assets, reputation, and operations. The role also involves ensuring compliance with regulatory requirements and aligning risk practices with strategic objectives.

A Head of Risk leads teams of analysts and managers who specialize in different risk categories—financial, operational, technological, and reputational. They work cross-functionally with executives, boards, and regulators, ensuring transparency and accountability across the business.

Strategic Importance in Modern Business

Risk is no longer an afterthought; it’s a strategic driver. The Head of Risk ensures that organizations are not caught off-guard by foreseeable challenges. For example, in financial institutions, they assess credit and market risks; in manufacturing, they focus on supply chain vulnerabilities; in tech, they manage cybersecurity threats and data protection.

By anticipating risks before they escalate, the Head of Risk provides leadership teams with critical insights that inform smarter decisions. This proactive mindset transforms risk management from a defensive tool into a competitive advantage—helping businesses innovate safely and adapt quickly to market shifts.

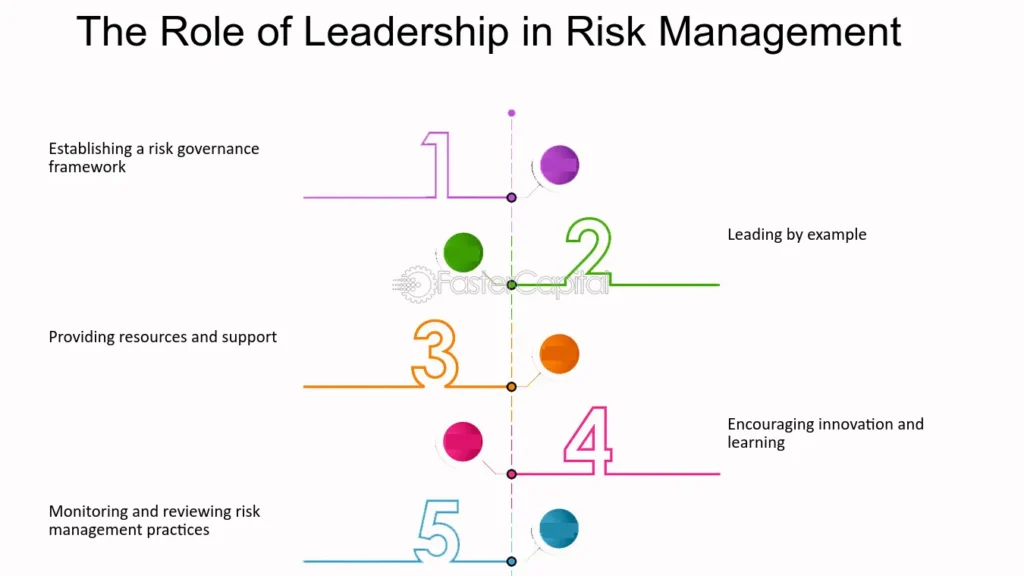

Key Responsibilities of a Head of Risk

Developing a Robust Risk Management Framework

One of the primary duties of the Head of Risk is to design, implement, and maintain a comprehensive risk management framework. This system outlines how risks are identified, assessed, monitored, and reported across the organization. It ensures consistency and accountability, allowing leadership teams to make decisions based on accurate, real-time risk data.

The framework typically includes policies, governance structures, and methodologies tailored to the organization’s size and industry. The Head of Risk must also ensure that this framework evolves alongside emerging threats—such as new technologies, regulations, and market dynamics.

3.2 Promoting a Risk-Aware Culture

A strong risk culture is essential to long-term success. The Head of Risk plays a key role in embedding this culture throughout the organization by training employees, raising awareness, and integrating risk considerations into daily operations. This ensures that risk management is not confined to a single department but becomes part of the company’s DNA.

By encouraging open communication about potential threats, near-misses, or ethical concerns, the Head of Risk builds a culture of transparency and trust. This cultural foundation helps companies detect issues early, avoid costly errors, and respond more effectively during crises.

Compliance and Governance Oversight

In addition to managing business risks, the Head of Risk is responsible for ensuring regulatory compliance and strong corporate governance. This includes staying updated on evolving laws, industry regulations, and global standards. Failure to comply can result in severe financial penalties and reputational damage—making this responsibility one of the most high-stakes aspects of the role.

They collaborate closely with internal audit, legal, and compliance teams to establish checks and balances, ensuring the organization remains both ethical and accountable.

Essential Skills and Qualities of a Successful Head of Risk

Analytical and Strategic Thinking

The role demands exceptional analytical skills—the ability to assess complex data, identify patterns, and draw insights that drive decision-making. A Head of Risk must combine technical expertise with strategic foresight, anticipating how future trends might impact business objectives.

Their analytical mindset allows them to quantify risks in financial terms, helping executives balance opportunity and caution. In essence, they act as the organization’s “risk radar,” guiding it safely through uncertainty.

Leadership and Communication

The most successful Heads of Risk are strong leaders and communicators. They must articulate complex risk concepts in a way that non-experts—such as board members or frontline staff—can understand. This skill is especially important when influencing high-level strategic discussions or responding to crises.

Leadership in this context also means being calm under pressure, decisive in uncertainty, and collaborative across departments. The Head of Risk must inspire confidence and foster a sense of shared responsibility among all employees.

Technical and Regulatory Expertise

Modern risk leaders must be fluent in data analytics, cybersecurity, and regulatory compliance. With the rise of AI, machine learning, and digital transformation, technical literacy has become non-negotiable. The ability to harness data-driven insights gives Heads of Risk the precision needed to forecast threats and prevent financial or operational losses.

Challenges Faced by Heads of Risk

While the role is highly rewarding, it is not without challenges. The pace of global change means new risks emerge faster than organizations can adapt. From geopolitical tensions to environmental crises and cyberattacks, the Head of Risk must constantly recalibrate strategies to stay ahead.

Another challenge is balancing risk aversion and innovation. Being overly cautious can stifle growth, while being too aggressive can lead to exposure. The best risk leaders understand this delicate equilibrium and know when to say “no” and when to take calculated chances.

Lastly, aligning risk priorities across global teams, managing stakeholder expectations, and keeping up with ever-changing compliance rules can test even the most experienced professionals. Nonetheless, these challenges make the role intellectually stimulating and vital to organizational success.

Conclusion

The Head of Risk is far more than a guardian against threats—they are architects of resilience and enablers of growth. Their work ensures that organizations can navigate uncertainty with confidence, adapt to change, and seize opportunities responsibly.

As the business landscape grows increasingly complex, the importance of this role will only continue to rise. Companies that invest in strong, visionary risk leaders are better equipped to turn potential setbacks into competitive advantages.

In today’s world, where risk and opportunity are two sides of the same coin, the Head of Risk stands at the intersection—balancing caution with courage, and insight with innovation.

Frequently Asked Questions (FAQs)

What does a Head of Risk do?

A Head of Risk oversees risk management frameworks, identifies threats, and implements strategies to protect organizational assets and reputation.

What qualifications are required for a Head of Risk role?

Most Heads of Risk hold degrees in finance, business, or risk management, along with certifications such as FRM (Financial Risk Manager) or PRM (Professional Risk Manager).

How is the Head of Risk different from the Chief Risk Officer?

In many organizations, the titles are interchangeable. However, larger firms may use “Head of Risk” for departmental leadership and “CRO” for enterprise-wide oversight.

Why is the Head of Risk role important?

The role ensures that organizations anticipate, understand, and manage potential threats—protecting both profitability and reputation.

What industries require a Head of Risk?

Sectors like finance, insurance, energy, healthcare, and technology all depend on skilled risk leaders to maintain compliance and ensure long-term sustainability.

You May Also Read: Dan Sodergren