Invest Engine: A Complete Beginner’s Guide to Smart Investing

Invest Engine has quickly emerged as a popular investment platform for individuals looking to grow their wealth through low-cost, efficient, and technology-driven investing. As more people move away from traditional brokers with high fees and complex structures, platforms like Invest Engine are redefining how everyday investors access financial markets. With a strong focus on simplicity, transparency, and affordability, Invest Engine appeals to both beginners and experienced investors alike.

In today’s digital-first financial world, investors want more control, fewer fees, and smarter tools to help them reach long-term goals. Invest’Engine fits squarely into this demand by offering commission-free investing and diversified ETF-based portfolios. Whether you prefer a hands-off managed portfolio or a fully self-directed approach, Invest’Engine provides flexible options designed to suit different risk levels and investment styles.

This article explores Invest Engine in depth, explaining how it works, its features, costs, advantages, and potential drawbacks. By the end of this guide, you will have a clear understanding of whether Invest Engine is the right investment platform for your financial journey.

What Is Invest Engine?

Invest Engine is a digital investment platform designed to help users invest efficiently using exchange-traded funds (ETFs). Rather than focusing on individual stock picking or speculative trading, Invest Engine emphasizes long-term, diversified investing strategies. Its core philosophy centers on making investing accessible, affordable, and easy to understand for a wide range of users.

The platform primarily serves investors who want exposure to global markets without the complexity of managing individual securities. By leveraging ETFs, Invest’Engine allows users to spread risk across multiple asset classes, industries, and regions. This approach aligns well with modern portfolio theory and appeals to those who value steady, long-term growth over short-term speculation.

Invest Engine is particularly attractive to cost-conscious investors. With commission-free trading and transparent pricing, it removes many of the traditional barriers that discourage people from investing. Its clean interface and educational focus further support users who may be new to investing or looking to simplify their financial strategies.

How Invest Engine Works

Getting started with Invest’Engine is a straightforward process. Users begin by creating an account, completing identity verification, and choosing an investment approach. Depending on personal preferences, investors can either select a managed portfolio or build their own ETF-based portfolio. This flexibility makes Invest’Engine suitable for a wide range of experience levels.

Managed portfolios are designed for hands-off investors who prefer professional allocation and automatic rebalancing. These portfolios are typically structured around different risk profiles, ranging from conservative to aggressive. Invest’Engine uses ETFs to construct diversified portfolios that align with the user’s selected risk tolerance and investment goals.

For more experienced investors, Invest Engine offers a self-managed option. This allows users to choose specific ETFs and customize their asset allocation. The platform also supports automated rebalancing and long-term investing principles, helping users maintain discipline and consistency over time without unnecessary complexity.

Key Features of Invest Engine

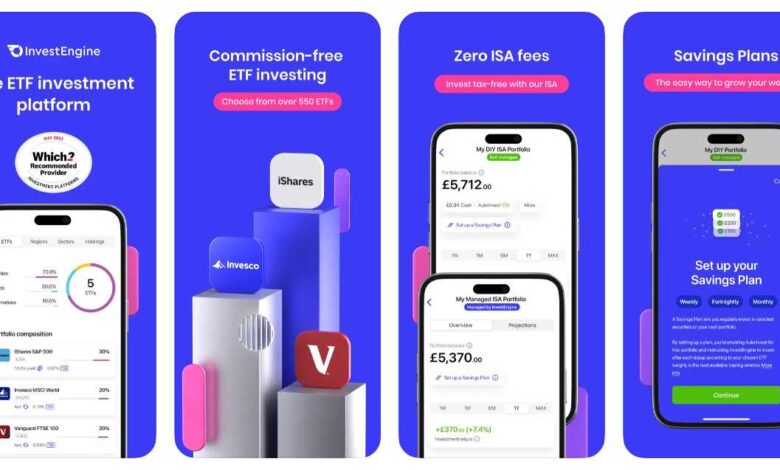

One of the standout features of Invest Engine is its commission-free investing model. Unlike traditional brokers that charge trading fees, Invest’Engine allows users to buy and hold ETFs without paying commissions. This significantly improves long-term returns, especially for investors who make regular contributions.

The platform also offers both managed and DIY portfolios, giving users the freedom to choose how involved they want to be. Managed portfolios are ideal for beginners, while self-managed portfolios appeal to investors who enjoy having full control over their investment decisions. This dual approach makes Invest Engine highly versatile.

In addition, Invest’Engine prioritizes security and usability. The platform uses modern encryption standards, complies with regulatory requirements, and provides a clean, intuitive interface. Its focus on transparency, combined with easy portfolio tracking tools, helps investors stay informed and confident about their financial decisions.

Invest Engine Fees and Costs

One of the biggest advantages of Invest Engine is its low-cost structure. The platform is widely known for offering commission-free ETF investing, which eliminates a major expense associated with traditional investment platforms. This makes Invest’Engine especially appealing for long-term investors focused on maximizing net returns.

For managed portfolios, Invest Engine may charge a modest management fee, depending on the specific service tier. These fees are generally lower than those charged by traditional financial advisors or robo-advisors. Importantly, all costs are clearly disclosed, helping users avoid unpleasant surprises.

By minimizing fees and avoiding hidden charges, Invest’Engine allows investors to keep more of their money working for them. Over time, these savings can compound significantly, making a noticeable difference in long-term portfolio growth.

Pros and Cons of Invest Engine

Invest Engine offers several compelling benefits. Its low-cost model, commission-free investing, and ETF-based diversification make it an excellent choice for long-term investors. The platform is easy to use, transparent, and suitable for both beginners and experienced users.

However, Invest’Engine may not be ideal for everyone. Investors looking to trade individual stocks, options, or cryptocurrencies may find the platform limiting. Advanced traders who rely on technical analysis tools or frequent trading strategies might also prefer a more feature-rich broker.

Despite these limitations, Invest Engine excels at what it is designed for: simple, cost-effective, long-term investing. For users aligned with this philosophy, its advantages far outweigh its drawbacks.

Is Invest Engine Safe and Reliable?

Safety is a critical concern for any investment platform, and Invest’Engine takes this responsibility seriously. The platform operates under regulatory oversight and follows strict compliance standards to protect user assets. Client funds are typically held separately from company assets, adding an extra layer of security.

In terms of technology, Invest Engine uses industry-standard encryption and data protection measures. This helps safeguard sensitive personal and financial information from unauthorized access. Regular audits and security updates further enhance platform reliability.

From a reputation standpoint, Invest’Engine has built trust through transparency, clear communication, and consistent performance. While no investment platform is entirely risk-free, Invest’Engine demonstrates a strong commitment to investor protection and operational integrity.

Conclusion

Invest Engine represents a modern approach to investing that prioritizes simplicity, affordability, and long-term growth. By focusing on ETF-based portfolios and eliminating unnecessary fees, it empowers investors to build wealth more efficiently. Its flexible structure makes it suitable for both hands-off beginners and confident DIY investors.

While it may not cater to active traders or those seeking speculative opportunities, Invest’Engine excels as a long-term investment solution. For individuals looking to invest smarter rather than harder, Invest Engine is a compelling platform worth serious consideration.

Frequently Asked Questions (FAQs)

What is Invest Engine best used for?

Invest Engine is best suited for long-term, ETF-based investing with a focus on low costs and diversification.

Is Invest’Engine suitable for beginners?

Yes, the platform is beginner-friendly and offers managed portfolios that require minimal investment knowledge.

Does Invest’Engine charge trading fees?

No, Invest’Engine is known for commission-free ETF investing, which helps reduce overall investment costs.

Can I manage my own portfolio on Invest Engine?

Yes, experienced investors can build and manage their own ETF portfolios using the self-managed option.

Is Invest Engine safe to use?

Invest Engine follows regulatory standards and uses strong security measures to protect user funds and data.

You May Also Read: Craig Tara